| |

UNDERSTANDING THE RESULTS:

The resulting BCG Product Portfolio Matrix has the following axes: the horizontal x-axis represents the Relative Market

Share (compared to the Most Important Competitor). A relative market share above 1 is considered to be a high relative market

share, it is considered to be low otherwise.

The resulting BCG Product Portfolio Matrix has the following axes: the horizontal x-axis represents the Relative Market

Share (compared to the Most Important Competitor). A relative market share above 1 is considered to be a high relative market

share, it is considered to be low otherwise.

The vertical y-axis represents the Product Market Growth. The delimiter is the Weighted Average Product Market Growth.

The product market growths are weighted by the relative market shares (default). Optionally you can select the Sales/Turnover

as weight set.

If you move your mouse over a bubble (product) you can see detailed figures such as relative market share, product growth, sales for the

selected product.

For a better understanding of this model, please also read the underlying assumptions and

limitations of the model.

QUESTION MARKS

"Question Marks" (A) are products that have a high product market growth and a low relative market

share (upper left quadrant).

These products need significant financial resources in order to maintain or even increase the market share. They will have to be

converted into "Stars" with the funds generated by the "Cash Cows".

STARS

"Stars" (B) have a strong growth and an important market share, financial resources are needed to ensure their growth. This

growth may slow down one day and these products will become "Cash Cows". Their high share and high growth assure the future.

CASH COWS

"Cash Cows" (C) have a relatively high market share and a low growth. They usually generate the cash that is needed to finance

the company's other activities, to finance the future.

DOGS

"Dogs" (D) experience both a slow growth and a low market share. Those products have difficulties to survive and do not

really help to finance other products. They may show an accounting profit, but the profit must be reinvested to maintain share, leaving no cash throwoff.

POSSIBLE STRATEGIES:

A balanced product portfolio has "Stars" who assure the future, "Cash Cows" that supply funds for that future growth,

and "Question Marks" to be converted into "Stars" with the added funds. "Dogs" should not figure in a balanced portfolio, they are failures.

Basically, there are four options available when facing product decisions:

- Develop:

This is the typical way for transforming a "Question Mark" into a "Star". The company tries to increase market shares.

This means that funds have to be allocated and as a consequence short-term profits may decrease.

- Maintain:

Maintain market shares. Often used for "Cash Cows" that are not likely to decline soon.

- Exploit:

Improve short term profitability even if this means a decrease in sales. Applies to declining "Cash Cows" and "Dogs".

- Abandon:

Close the business units that have become non profitable: "Dogs" or products that remain "Questions Marks", that couldn't be converted

to "Stars".

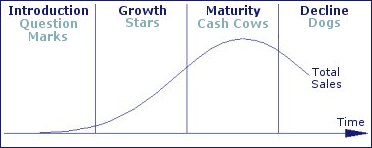

A theoretical strength of the BCG Model is that it can be linked to the PLC (Product Lifecycle) Model (cf.

"underlying assumptions and limitations"): "Questions Marks" -hopefully- become "Stars".

At maturity those "Stars" become "Cash Cows" and during the decline phase of the PLC they will become "Dogs".

See illustration below:

BCG and PLC Model

| |